Business Info

Ashcroft Capital Lawsuit: A Deep Dive into the Case, Allegations, and Lessons for Investors

Published

7 months agoon

By

Admin

Introduction

When a lawsuit involves a well-known investment firm, it doesn’t just affect the company — it sends ripples throughout the financial world. The Ashcroft Capital lawsuit has done exactly that, sparking questions about transparency, investor protection, and the importance of due diligence in real estate investments.

This article takes you through the full story — from the background of Ashcroft Capital to the lawsuit details, potential implications, and what investors can learn to safeguard their own portfolios.

Background on Ashcroft Capital

Ashcroft Capital is a prominent real estate investment firm that focuses primarily on multifamily apartment communities across the United States. Founded with the goal of offering investors steady returns through real estate, the company has built a reputation for acquiring, renovating, and managing properties in growing markets.

The firm’s business model is straightforward:

- Identify undervalued or underperforming properties.

- Improve them through renovations and better management.

- Increase occupancy and rental income.

- Deliver returns to investors.

Over the years, this strategy has attracted thousands of investors — from first-time real estate backers to seasoned professionals looking for passive income opportunities.

How the Lawsuit Came to Light

The Ashcroft Capital lawsuit began making headlines when allegations surfaced about the company’s handling of certain investment projects. Reports indicated that some investors claimed misrepresentation of returns, lack of transparency in financial reporting, and disputes over property valuations.

While lawsuits in the investment world aren’t uncommon, the Ashcroft Capital case stands out because:

- It involves a large pool of investors across multiple states.

- It focuses on real estate syndication, a sector that is booming but not as heavily regulated as traditional securities.

- It raises questions about how investor funds are managed and reported.

Key Allegations in the Ashcroft Capital Lawsuit

Although the details may vary depending on the plaintiff, some of the common allegations include:

- Misrepresentation of Investment Performance

Investors allege that projected returns were overly optimistic and not supported by actual performance data. - Inadequate Disclosure of Risks

Some claim they were not fully informed of potential market risks, vacancy rate impacts, and renovation delays that could reduce profitability. - Financial Reporting Discrepancies

The lawsuit suggests there were inconsistencies in reported profits, making it difficult for investors to track their earnings accurately. - Breaches of Fiduciary Duty

This refers to accusations that the company did not act solely in the best interest of investors when making certain business decisions.

Ashcroft Capital’s Response

Like any firm facing legal action, Ashcroft Capital has strongly denied wrongdoing. Publicly, the company maintains that it operates with integrity, compliance with applicable laws, and a commitment to transparency.

It’s not unusual for disputes like this to end in settlements rather than court verdicts. Many times, investment-related lawsuits conclude with agreements that include:

- Financial settlements to investors.

- Changes in business practices.

- Strengthened compliance measures.

What This Means for Investors in Real Estate Syndications

The Ashcroft Capital lawsuit is not just about one firm — it’s a wake-up call for the entire real estate syndication industry.

Here are a few key takeaways:

1. Always Conduct Independent Due Diligence

Never rely solely on a company’s marketing materials. Look for third-party reviews, property market trends, and comparable sales data before investing.

2. Understand the Risk-Return Profile

High projected returns often come with high risks. In real estate, factors like interest rate hikes, property damage, and market slowdowns can quickly erode profits.

3. Review Contracts Carefully

Every investment agreement contains fine print about fees, exit clauses, and risk disclosures. Hiring a lawyer to review these documents can be worth the cost.

4. Diversify Your Portfolio

Investing all your capital in a single syndication or firm is risky. Spread your investments across different asset classes and markets.

Legal and Regulatory Aspects

Real estate syndications like those offered by Ashcroft Capital fall into a unique legal category. They often involve private placements under Regulation D of the U.S. Securities and Exchange Commission (SEC).

While this allows firms to raise capital without the same disclosure requirements as public companies, it also means:

- Investors must often be accredited (meeting certain income/net worth thresholds).

- There’s less publicly available information compared to stocks.

The SEC and state regulators can still investigate if there are allegations of fraud, misrepresentation, or breach of securities laws. You can read more about investor protections on the official SEC Investor.gov portal.

Possible Outcomes of the Ashcroft Capital Lawsuit

Depending on how the case develops, possible outcomes include:

- Financial Compensation for Investors

If the plaintiffs succeed, affected investors could receive monetary settlements or court-awarded damages. - Changes in Business Operations

Ashcroft Capital might revise its disclosure practices, reporting methods, or investment criteria. - Reputational Impact

Even if the company wins the case, public perception may shift, which could impact future fundraising.

Lessons for the Broader Investment Community

The Ashcroft Capital lawsuit reinforces that trust is essential in any investment relationship. It also highlights the need for:

- Stronger regulatory oversight of private real estate offerings.

- Better investor education on the risks of illiquid investments.

- Transparent communication between firms and investors.

For those interested in deepening their understanding of safe investment practices, Nolo’s Investor Protection Resources offers helpful legal guides.

Final Thoughts

The Ashcroft Capital lawsuit is more than just a legal battle — it’s a case study on the importance of due diligence, transparency, and investor rights. Whether you are considering investing in a real estate syndication or any other private placement, this case serves as a reminder to ask the right questions, verify claims, and protect your capital.

Real estate can be a lucrative investment, but only when backed by clear information and ethical business practices.

Also Read:5StarsStocks.com 3D Printing Stocks: Your Full Investment Guide for 2025 and Beyond

You may like

OTHER POSTS

Understanding DGH A: The Heart of India’s Hydrocarbon Management and Its Role in Securing Energy Future

India’s energy sector is undergoing significant transformation, marked by a strategic drive to become more self-reliant in energy production. At...

Tech eTrueSports: Redefining the Future of Esports Through Technology

Introduction: The Rise of Tech in Esports The esports industry has exploded in the past decade. According to Newzoo’s 2024...

Comporium Webmail: The Ultimate Guide to Login, Setup, Features, and Troubleshooting.

In today’s digital world, staying connected through reliable email communication is essential. Whether you’re a professional managing clients or a...

PLG Supplies: The Ultimate Guide to Pipeline & Gas Industry Essentials

Introduction – The Backbone of Modern Infrastructure Ever wondered what keeps oil, gas, or water flowing through thousands of miles...

Gabriel Macht Net Worth 2025: Career, Earnings, Assets, and Lifestyle

Introduction If you’ve ever watched Suits, you know Harvey Specter — the sharp, confident lawyer who always plays to win....

Understanding “i n c r e a ”: Meaning, Data, and Real-World Applications

Introduction The word “i n c r e a” is among the most universally used concepts across disciplines — from...

Misha Ezratti Net Worth (2025): Inside the Fortune and Legacy Behind GL Homes

Introduction In Florida’s booming real estate market, few names carry as much influence and respect as Misha Ezratti. As the...

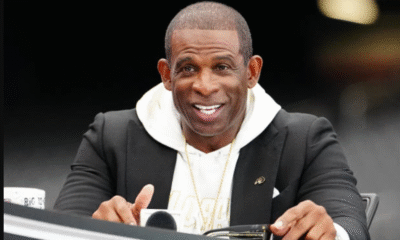

Deion Sanders Net Worth 2025: How “Prime Time” Built His $60 Million Fortune

Introduction When you hear the name Deion Sanders, one word comes to mind: Prime Time.From blazing speed on NFL fields...

Dan Newlin Net Worth 2025: Lawyer’s Wealth, Career, and Success Story

Introduction: More Than Just a Number When people search “Dan Newlin Net Worth 2025,” they aren’t only curious about how...

Tommy Mottola Net Worth & Biography: From Bronx Beginnings to Global Business Icon

Introduction When it comes to wealth, influence, and legacy in the entertainment and business world, few names stand out as...

Understanding DGH A: The Heart of India’s Hydrocarbon Management and Its Role in Securing Energy Future

Tech eTrueSports: Redefining the Future of Esports Through Technology

Comporium Webmail: The Ultimate Guide to Login, Setup, Features, and Troubleshooting.

AnonIB AZN: The Dark Truth Behind Anonymous Image Boards and Why You Should Stay Away

Crypto30x.com TNT Review: Full Guide, Benefits, Risks & Price Forecast

iofbodies.com Applications: Your Body’s Digital Mirror in a Smarter World

Trending

Tech News8 months ago

Tech News8 months agoAnonIB AZN: The Dark Truth Behind Anonymous Image Boards and Why You Should Stay Away

Crypto & Blockchain Info5 months ago

Crypto & Blockchain Info5 months agoCrypto30x.com TNT Review: Full Guide, Benefits, Risks & Price Forecast

Technology Info10 months ago

Technology Info10 months agoiofbodies.com Applications: Your Body’s Digital Mirror in a Smarter World

FinTech Info9 months ago

FinTech Info9 months agoFintechzoom.com Crypto Mining: Your 2025 Guide to Smarter Mining